Contracts for Difference (CFDs) have become a well known type of trading among those looking to tap into financial markets without buying the main assets. But what exactly are CFDs, and how do they perform? This information reduces the necessities of cfdss trading and highlights its benefits for traders seeking mobility and accessibility.

Understanding CFDs

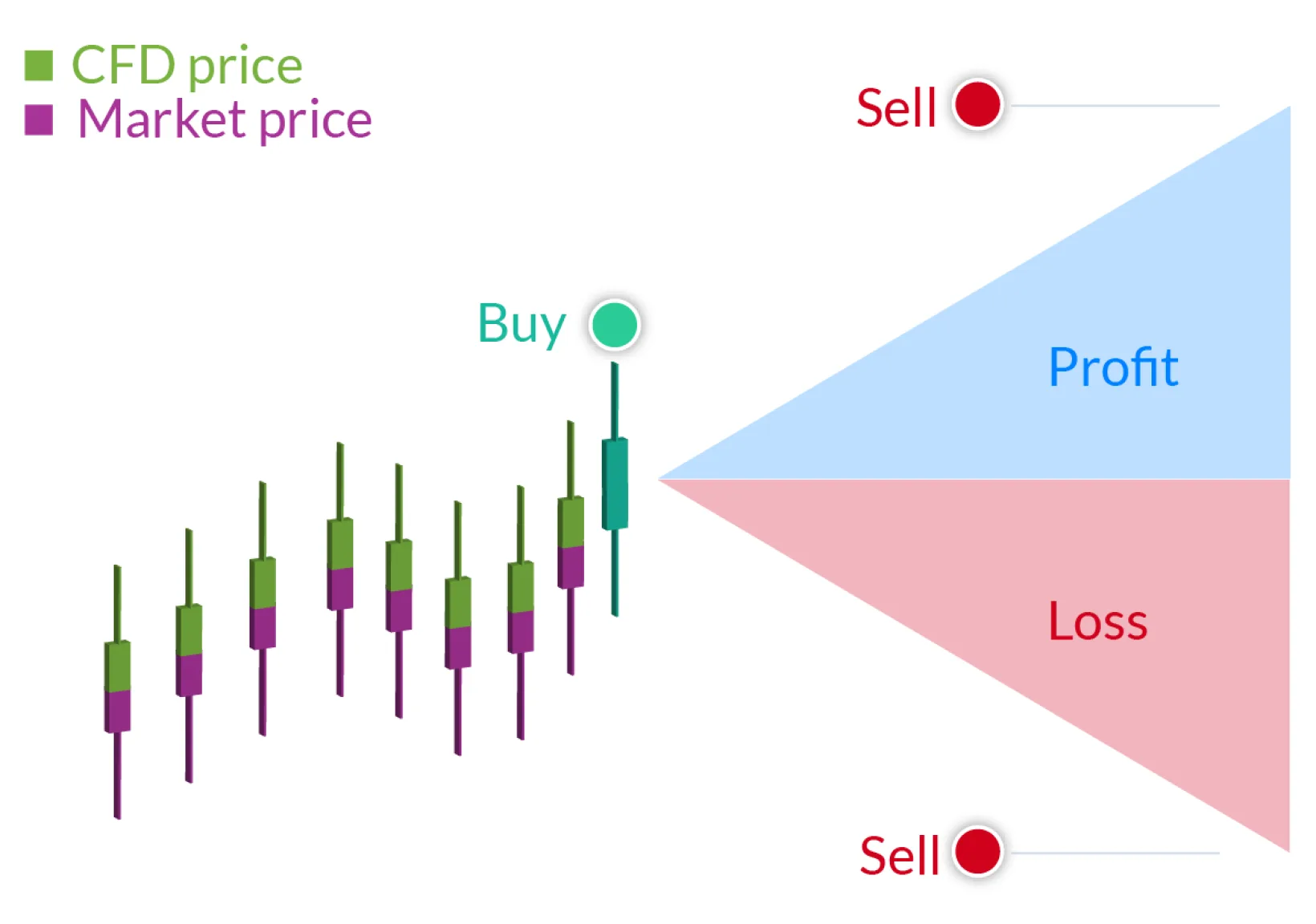

A Contract for Big difference (CFD) is a financial derivative that lets you speculate on the purchase price activities of numerous resources such as shares, forex, commodities, and indices. When trading CFDs, you enter an deal with a broker to change the huge difference involving the opening and ending rates of an asset, without really possessing the advantage itself. You are able to income by speculating on the motion of industry, whether it's going up or down.

For example, if you think the price tag on an inventory will probably increase, you are able to open a "buy" (long) position. Conversely, if you think the price will drop, you are able to start a "sell" (short) position. By capitalizing on industry volatility, CFD trading offers an flexible and dynamic method for investors.

Benefits of CFD Trading

CFDs offer several special benefits that appeal to traders searching for diverse opportunities. Below are some key benefits:

1. Access to a Wide Range of Markets

CFDs provide traders use of many different financial areas, including forex, stocks, commodities, cryptocurrencies, and indices—all from a single platform. That diverse selection is fantastic for traders seeking to expand their profile and explore various asset courses and never having to manage multiple accounts.

2. Opportunity to Trade in Both Rising and Falling Markets

One of the standout options that come with CFD trading is flexibility. Unlike conventional trading, which often connections success to rising markets, CFDs allow one to profit from value actions in often direction. Whether industry is bullish or bearish, you can position you to ultimately seize opportunities.

3. No Ownership of Assets

Unlike old-fashioned buy-and-hold investments, CFD trading doesn't require buying the underlying assets. This eliminates the logistical concerns of possession, such as for instance storage or custody, which is very helpful for commodities like silver or oil.

4. Efficient Use of Capital

CFD trading needs merely a portion of the full total trade value upfront. This effective use of capital allows traders to diversify their roles without attaching up substantial funds. Additionally it may make entering international areas more available for specific traders.

5. Streamlined Trading Platform

Modern CFD brokers typically offer user-friendly platforms set with sophisticated tools and features to simply help traders analyze and accomplish their trades effectively. Real-time charts, specialized indicators, and chance management resources can improve your trading knowledge and decision-making.

6. Round-the-Clock Trading Opportunities

Several CFD markets work 24/5 as well as 24/7, especially in case of cryptocurrency CFDs, giving traders the flexibility to industry at their convenience irrespective of time zones. That extended trading window guarantees you don't skip options in world wide markets.

How CFD Trading Works

Trading CFDs is simple when you grasp the basics. Here's how it generally works:

Select an Advantage – Determine the asset you want to industry, such as forex or stocks.

Analyze the Industry – Use maps, information, and signals to estimate whether the price may rise or fall.

Open a Position – Position a trade, going long (buy) if you expect the price to boost or going small (sell) in the event that you anticipate an amount drop.

Monitor Your Industry – Utilize the platform's tools to track your place and handle risk.

Close the Position – Quit the business when you wish to lock in your gains or minimize losses. The huge difference between the opening and closing rates establishes your outcome.

Final Thoughts

CFDs are a effective tool for individuals who desire to participate in active trading without seeking to own the main assets. Using their capability to trade numerous areas, profit from both increasing and falling prices, and structured platforms, CFDs provide a persuasive choice for traders looking for mobility within their strategies.

:max_bytes(150000):strip_icc()/CFD-2676f84c6638433fac5db6023f01cdf5.png)

If you're interested in getting deeper ideas into CFD trading and exploring their possible, begin by choosing a well-researched broker and training with a test account. CFDs are about changing to advertise trends and keeping informed—your crucial to creating smarter trading decisions.